It is widely assumed that health care is the most regulated industry in the United States. But aviation services companies, such as Universal Weather and Aviation, a provider of trip facilitation logistics for the operators of business jets and operates facilities in jurisdictions around the world, face a dizzying array of domestic federal regulations as well as global compliance concerns.

Serving more than fifty locations in more than twenty countries and a contract fuel program that has 19,500 subscribers, Omar Fahel, senior vice president and general counsel, is busy.

Fahel came from the oil and gas industry, so he was no stranger to managing complex patchworks of local laws and customs along with large-scale global agreements. He lived in Saudi Arabia, Bahrain, and Dubai and became accustomed to working within the confines of civil, common, and Sharia law, as well as understanding the differences, limitations, and nuances of each. Fahel also spent a significant portion of his career negotiating oil and gas deals in Africa, dealing directly with government entities and regulatory bodies. This extensive international experience is one of the main reasons he was hired at Universal.

“An act like the Foreign Account Tax Compliance Act forces foreign banks to do additional work to comply with US regulations. It benefits us to be able to do business in dollars, but there are instances where banks choose not to take on our accounts because of the extra responsibilities.”

In one extreme instance prior to joining Universal, he had to negotiate cross-border security agreements between two African countries to protect drill ships from Somali pirates. This included specifying the exact hand-off points between the naval escorts to avoid violating the territorial waters of either nation.

“There were other candidates for my job with more aviation experience, but my background in international law better prepared me for the range of legal, commercial, and compliance issues we face,” Fahel says.

There are numerous US guidelines and regulations that extend well beyond its physical borders and demand substantial attention from Fahel and his legal team. A sampling includes: anti-money-laundering regulations; the Office of Foreign Assets Control, which enforces economic and trade sanctions against a variety of nations and is evolving as new relationships develop with Cuba and Iran; the Foreign Corrupt Practices Act, requiring transparent accounting practices and prohibiting improper payments to foreign government officials; and the Foreign Account Tax Compliance Act that compels companies and citizens to report any foreign accounts they may hold to the Internal Revenue Service.

To illustrate how these types of regulations can impact business around the world, Fahel explains, “An act like the Foreign Account Tax Compliance Act forces foreign banks to do additional work to comply with US regulations. It benefits us to be able to do business in dollars, but there are instances where banks choose not to take on our accounts because of the extra responsibilities, so doing business in those areas becomes more difficult.”

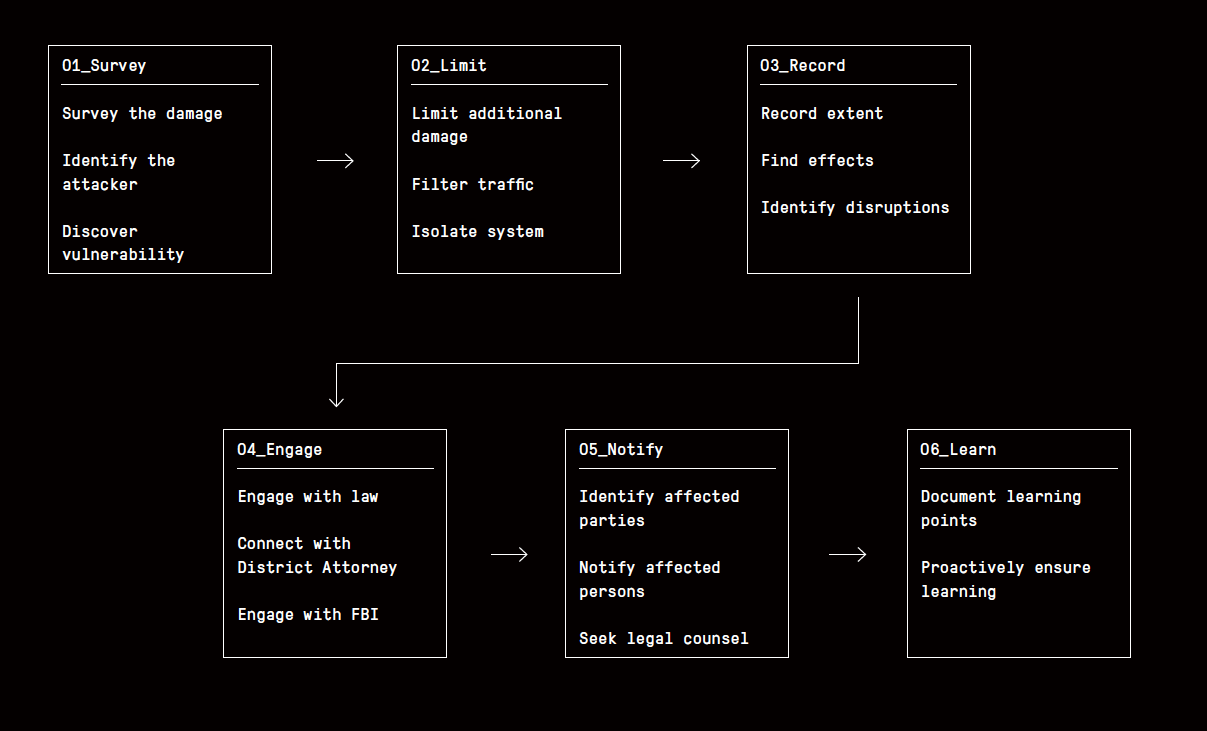

Data security has become a global concern within all international jurisdictions. In addition to the huge negative impact a data breach would have on customer and public relations, there are government sanctions for having inadequate measures and controls in place.

Fahel works with Universal’s chief compliance and security officers to implement regular software security updates to ensure the sensitive data of its customers is always protected from malicious threats.

As with data security, overall regulatory compliance goes well beyond strict legal implications and penalties to include potential impact to Universal customers directly.

For example, if a Department of Justice investigation discovers payment has been made to an individual who the company was unaware of being on the Specially Designated Nationals List, its Fortune 500 clients may also be legally complicit, depending on the specific terms of their contracts.

“No matter what the issue, I prioritize acting as a strategic business partner and determining how to promote the business while still protecting the company.”

“We are obsessively thorough with all our due diligence activities. Such a robust, responsible vetting process is not only reassuring to our customers, but also gives us a distinct advantage over our competitors.

“Before ever doing business with us, many of our clients’ first questions are about our overall compliance program and specifically about our Foreign Corrupt Practices Act program,” Fahel points out.

Europe presents an entirely different set of concerns. While various countries have their own sets of employment, security, and business integrity guidelines, the European Union presented a challenge when it allowed the Safe Harbor agreement to expire. The Safe Harbor allowed data to be exchanged between member countries and the United States when protected by adequate proscribed security.

Now, new shield requirements have been introduced that demand extensive rights and guarantees to the data privacy of individuals.

Though there is two-year window for implementation and no formal agreement yet specifying new terms, there is the potential of a €20 million fine—or 4 percent of global turnover—for noncompliance. Fahel and his team are in the process of working with European regulators and outside counsel to develop a variety of contingency plans in order to comply with the regulations.

Asked if his colleagues appreciate how he manages so many global challenges simultaneously, Fahel says, “Mostly I think they appreciate that I always try to bring a positive solution to a problem.

“No matter what the issue,” he continues, “I prioritize acting as a strategic business partner and determining how to promote the business while still protecting the company.”